/ Research, DeFi, Publication

The Tokenization of Assets: Using Blockchains for Equity Crowdfunding

Research paper by Jakob Roth, Fabian Schär, Aljoscha Schöpfer

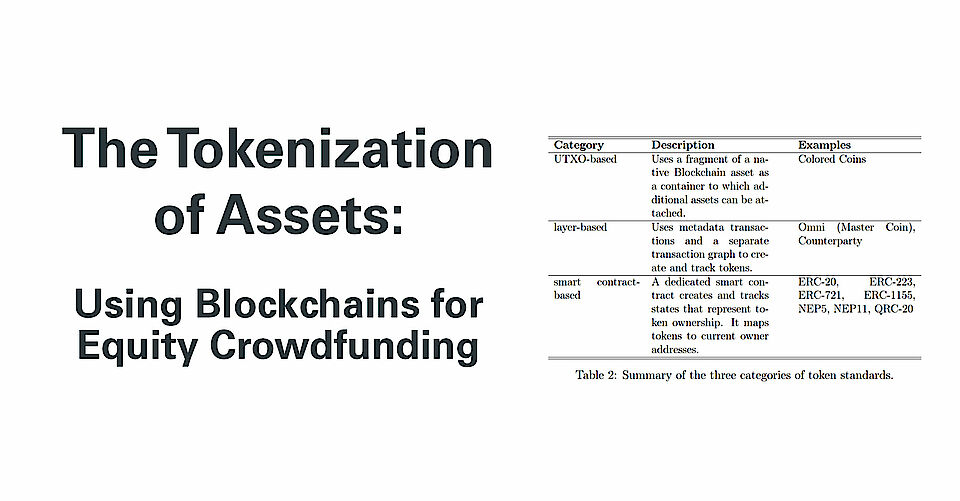

In this chapter, we present tokenization of equity crowdfunding on a Blockchain as a possible approach to ease access to capital for startups. We propose a categorization of token standards into UTXO-based, layer-based and smart contract-based tokens. In a second step, we analyze the advantages that tokenization can bring, such as cryptographically secured ownership, programmability of assets, access to the Blockchain-ecosystem, enhanced divisibility of shares as well as the formation of a well-functioning secondary market. Tokenization allows to decouple the ledger of assets from the crowdfunding platform, thus lowering the cost of secondary market trading and the intermediary’s power. We conclude by mentioning several drawbacks including information asymmetries between investors and campaign creators, regulatory issues and high energy intensity of Proof-of-Work-secured Blockchains.